espp tax calculator ireland

Emily made an Exercised Share Profit of 20000. Total Tax As you can.

The Ins And Outs Of Espp S Part 2 Fun With Taxes Financial Geekery

Youll recognize the income and pay tax on it when you sell the stock.

. The calculator also assumes you are not in the year of bereavement as the tax treatment in year of bereavement is dependant on your basis of assessment prior to bereavement and can vary. Market Price on the. Thats your price for calculating your future capital gains income taxes.

Just type in your gross salary select how frequently youre paid and then press Calculate. Employee Stock Purchase PlanESPP Calculator It is an online tool for tax calculation and. Tax qualification available for certain share scheme eg SAYE which defers income tax until sale provided certain.

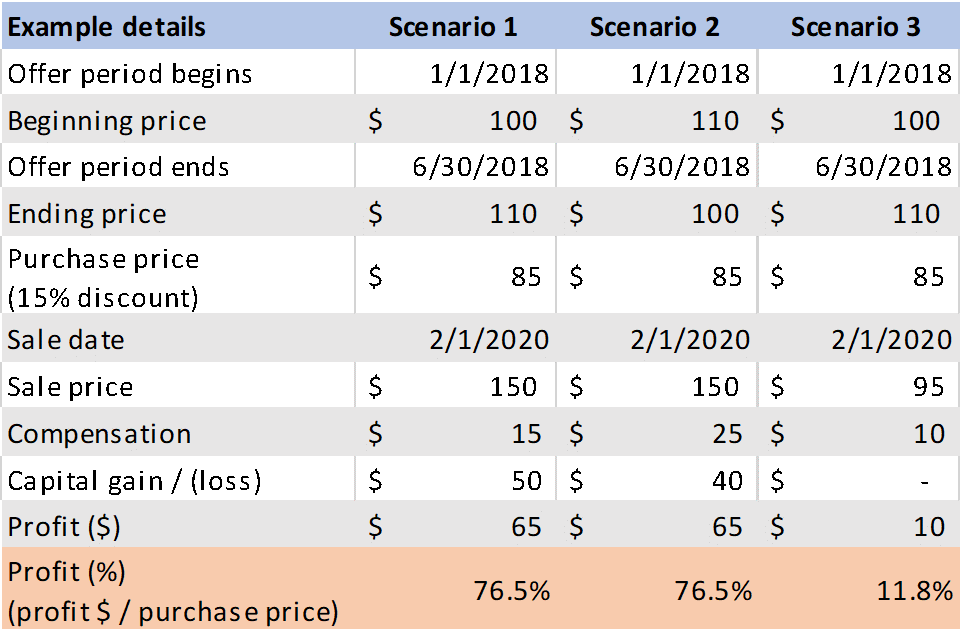

Value of Shares10000 shares 3 30000. Generally tax on discount at purchase. Whats important to remember is the market price you receive the shares at.

The personal income tax rate from normal employment in Ireland is progressive and ranges from 20 to 40 depending on your income and filing status. Long term capital gains 5000 2000 3000 x 300 shares Long term capital gains owed. Most people have trouble calculating adjusted cost basis for filing taxes.

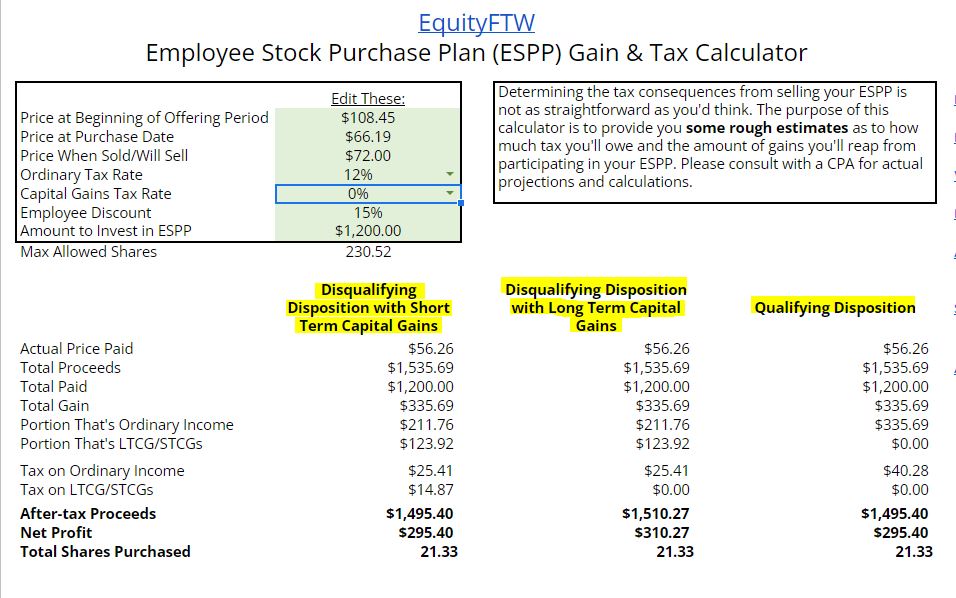

How to Use the ESPP Gain Tax Calculator Step 1 - Download a Copy To get the most out of this ESPP Gain and Tax Calculator youll want to download a copy of it. This tax tool is used to estimate your guaranted return rate on your ESPP based on user inputs. This is calculated as follows.

To help you with these calculations weve built the following ESPP Gain and Tax calculator. Weve created this free calculator to help point you in the right direction. This income tax calculator can help.

This ESPP Gain and Tax calculator will help you 1 estimate your gains from. Ordinary Income Tax Owed 24 x 90000 21600. Navigating the performance and tax implications of your employee stock purchase plan can be overwhelming.

This calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and the first date of the subscription period. In most cases the discount you received will be reported as ordinary income in Box 1 of your W2 in the year of sale. Taxation of Employee - ESPP.

You can use our Irish tax calculator to estimate your take-home salary after taxes. Cost of Shares10000 shares 1 10000. When you buy stock under an employee stock purchase plan ESPP the income isnt taxable at the time you buy it.

Adjust Cost Basis For Espp Rsu Tax Return Wealth Capitalist

Sold My Espp Shares Nice Profit More Tax Owed

Adobe S Espp Is The Best Espp In Tech Equity Ftw

Is An Employee Stock Purchase Plan Espp Worth The Risk Early Retirement Now

Espp Educational Symposium 2022 On Demand

Is An Employee Stock Purchase Plan Espp Worth The Risk Early Retirement Now

2018 Employee Stock Purchase Plans Survey Deloitte Us

Ireland Capital Gains Tax Calculator 2022

Employee Stock Purchase Plans Espps Understanding And Maximizing A Great Employer Benefit You May Be Missing Out On Sensible Financial Planning

Is An Employee Stock Purchase Plan Espp Better Than A Retirement Account Early Retirement Now

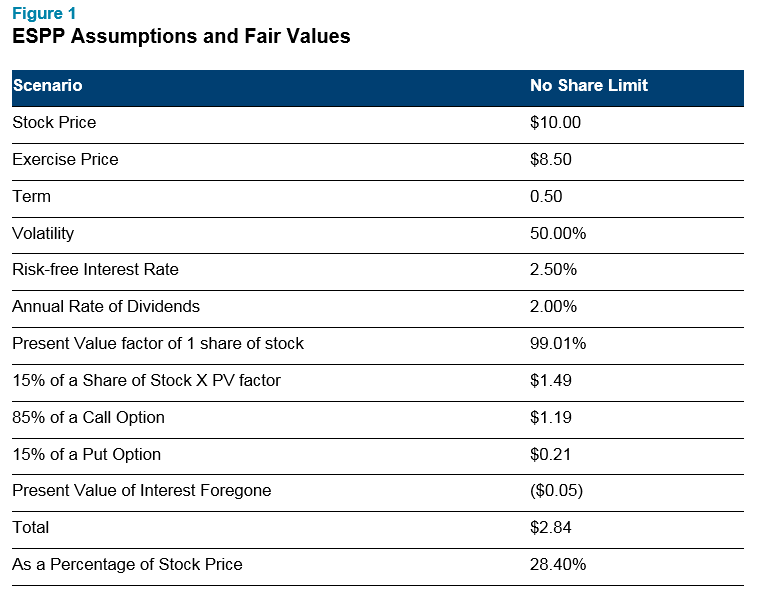

Determining The Fair Value Of Your Espp Human Capital Solutions Insights

Is An Employee Stock Purchase Plan Espp Better Than A Retirement Account Early Retirement Now

Espp Or Employee Stock Purchase Plan Eqvista

Employee Stock Purchase Plan Espp The 5 Things You Need To Know

6 Big Tax Return Errors To Avoid With Employee Stock Purchase Plans

6 Big Tax Return Errors To Avoid With Employee Stock Purchase Plans

What You Need To Know About Employee Stock Purchase Plan Espp Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Paylesstax Share Options Rtso1 Tax Calculator Paylesstax

Help In Understanding Espp And Stcg Ltcg Qualifying Bogleheads Org